Introduction

Have you noticed that when you go to a bank these days, the most eye-catching thing isn’t the teller, but the oversized LED screen?

It’s not just dazzling, it also displays a variety of financial information in real time.

Don’t underestimate this screen; it’s more than just a decorative element; it’s the secret weapon for upgrading banking services!

Today, let’s discuss why banks are so fond of using LED screens and what makes them so effective.

Table of Contents

1. Why Banks Need LED Screens to Deliver Real-Time Financial Information

When you walk into a bank, the first thing you might notice isn’t the teller, but the large LED screen in the lobby.

It displays the latest interest rates, foreign exchange rates, and financial product yield curves, making it easy to see at a glance and much more convenient than browsing a mobile app or reading paper announcements.

Banks handle a wide range of transactions at a rapid pace.

Exchange rates fluctuate rapidly, financial products are updated daily, and loan rates and service policies are subject to constant revision.

If this information remains on paper announcements, customers can easily access outdated data, making it difficult to make informed decisions.

Traditional methods are also somewhat slow. Mobile apps require manual operation and are sometimes slow to update; paper notices are outdated and contain limited information.

And asking a teller requires waiting in line, which takes up staff time. In contrast, LED screens offer a much more convenient experience.

Information updates almost in real time, and text, charts, and graphs can be displayed simultaneously, making complex data easy to understand at a glance.

For customers, this display method is both intuitive and hassle-free.

As you enter the bank lobby, the latest information scrolls across the LED screen, accompanied by a call system and business guides, making the entire process much smoother.

The bank also looks more modern and professional, giving people a sense of security.

For banks, LED screens are equally useful. Tellers no longer have to answer repetitive questions, making their work much easier.

They can also showcase new products and promotions, combining information dissemination with marketing.

Best of all, all customers see the same information, eliminating confusion based on different channels.

In short, LED screens make banking information faster and more intuitive, providing a smoother customer experience.

In modern banking, they are no longer just a decorative element; they are a real tool for improving customer satisfaction and efficiency.

2. Common Application Scenarios of LED Displays in Banks

1) Real-Time Financial Information in the Lobby

LED screens can display the latest exchange rates, deposit and loan rates, and stock market indices.

For example, upon entering the bank lobby, you can see the latest exchange rates for the US dollar and euro, or the yield curve for a particular wealth management product.

All at a glance, without having to look at your phone or ask the teller, “What’s the current interest rate?”

2) Smart Queuing and Calling Information

Many banks combine LED screens with call-calling systems to display the current service window and waiting status in real time.

For example, a screen message like “Window 3 is processing a transaction, please proceed to Customer A” makes waiting in line less boring and reduces anxiety.

Customers can review their documents while viewing the screen, feeling more at ease.

3) Policy and Announcement Releases

LED screens can quickly inform customers of new service launches, regulatory updates, or branch announcements.

For example, if a bank launches a zero-fee wealth management account, the screen will scroll through promotional information, making it easy for customers to understand and avoid missing out.

4) Risk Warnings and Safety Education

LED screens can also broadcast anti-fraud messages or operational risk reminders.

Such as “Don’t trust remittances from unfamiliar phone calls” or “Pay attention to bank card password security.”

This helps customers be more vigilant and aware of security issues when conducting transactions.

5) VIP Areas or Foreign Currency Counters

In VIP areas or foreign currency counters, LED screens display real-time foreign exchange and gold prices and investment returns.

For example, if you exchange US dollars, the screen will show the current exchange rate and yesterday’s change, allowing you to make more intuitive choices.

6) External Facade Advertising Screens

LED screens are also common on bank facades, displaying scrolling information about financial products, credit card offers, or financial tips.

These not only attract passersby’s attention but also give the bank a more modern and technological look.

3. Technical Advantages of LED Displays in Real-Time Financial Information Delivery

The lighting in bank halls is often complex, sometimes with direct sunlight and sometimes with bright indoor lighting.

Ordinary screens can easily reflect light or become difficult to read. LED screens, with their high brightness and high definition, clearly display information even in bright sunlight.

No matter where customers walk into the bank lobby, they can easily see exchange rates, interest rates, or wealth management product data without squinting or crowding in front of the screen.

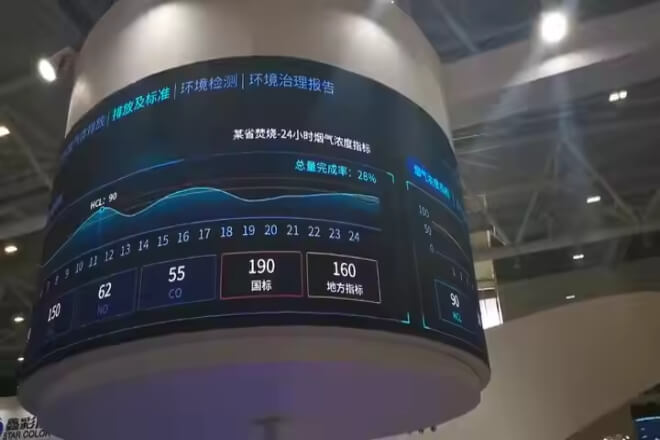

LED screens can directly connect to the bank’s back-end systems or various financial data sources, enabling real-time updates.

For example, if the US dollar exchange rate fluctuates, the data on the screen will be refreshed almost instantly.

Allowing customers to see the latest information when conducting foreign currency exchange or wealth management transactions without delay or error.

Large bank branches often have multiple areas with different display needs. LED screens support multi-screen interaction.

Allowing them to display exchange rates and wealth management products in the lobby and gold prices and investment trends in the VIP area or foreign currency counter.

This allows different customers in different areas to receive targeted information, making service more precise and the overall bank environment more organized.

LED screens can display not only text and numbers, but also charts, dynamic curves, and even animations.

For example, a dynamic display of a wealth management product’s yield curve on the screen allows customers to quickly identify rising and falling trends, which is more intuitive than simple text descriptions.

The real-time curves in the foreign exchange window also allow customers to quickly assess exchange rate fluctuations and facilitate decision-making.

Bank information transmission requires continuous, reliable, and uninterrupted operation.

LED screens typically feature high stability and redundant designs, ensuring that even if a problem occurs in a single module, the overall display remains intact.

Customers have ready access to information, which enhances the bank’s image and creates a more professional and trustworthy impression.

In short, LED screens are more than just a “display tool”; they make complex financial information intuitive, timely, and readable.

Whether a customer is quickly browsing interest rates or a VIP client is monitoring gold trends, LED screens facilitate smoother information transmission and enhance the customer experience.

4. Types of Financial Information Displayed on LED Screens

1) Basic Information

Basic information is the most common type of content displayed on bank LED screens, including interest rates, exchange rates, and deposit product information.

For example, when a customer enters the lobby, the screen will display the latest exchange rates for major currencies like the US dollar, euro, and yen, as well as interest rates for time deposits and demand deposits.

For those seeking to quickly understand bank products, this type of information is intuitive and clear, eliminating the need to ask a teller or browse a mobile app.

2) Market Information

Market information primarily covers stock indices, precious metals, and foreign exchange.

For example, the screen can display real-time dynamic changes in the Shanghai Composite Index, Shenzhen Component Index, or gold and silver prices, and can also display recent trends using line charts.

When conducting investment or wealth management transactions, customers can quickly understand market trends and decide whether to make purchases or exchanges through the LED screen.

This is particularly suitable for VIP clients and financial advisors, making investment decisions more intuitive and scientific.

3) Policy Information

Banks frequently need to communicate information such as central bank policies or regulatory announcements.

LED screens can be used to scroll through the latest interest rate adjustments, financial management regulations, foreign exchange regulations, or branch service changes.

For example, when the central bank lowers the benchmark deposit and lending rates, the screen will update simultaneously to explain the impact of the new policy on ordinary depositors.

This allows customers to be immediately informed of policy changes, avoiding confusion or inconvenience caused by delayed information.

4) Service Information

LED screens can also enhance the bank’s service experience. Service information includes queue status, business hours, and branch service guides.

For example, the screen might display “Window 3 is currently processing a transaction, please proceed to Customer A.”

Or remind customers of weekend closing hours or the location of newly opened self-service kiosks.

Customers can use the screen to assess queue conditions and schedule their transactions appropriately, avoiding anxious waits and making branch operations more efficient.

5) Marketing Information

In addition to providing financial information, LED screens can also facilitate marketing and promotional activities.

They can scroll through recommendations for wealth management products, loan promotions, credit card offers, or information on newly launched services.

For example, information about rising returns on wealth management products or new customer promotions can be dynamically displayed with text and graphics, allowing customers to learn about the products while waiting.

This creates a more natural and intuitive promotional experience and improves the bank’s marketing efficiency.

Overall, LED screens are not just information display tools; they are integrated platforms for banking services, customer experience, and marketing promotions.

They allow customers to quickly access financial information, policy changes, and service content the moment they enter the bank, while enjoying a more convenient and professional banking experience.

5. Considerations for Banks Deploying LED Screens

1) Information Accuracy

The data displayed on bank LED screens must be absolutely accurate.

Inaccuracies in interest rates, exchange rates, stock market indices, or financial product returns can mislead customers and even damage the bank’s reputation.

To this end, screens need to be directly connected to core banking systems or reliable third-party financial data sources to ensure real-time data updates, zero latency, and zero errors.

For example, if a customer wants to exchange foreign currency, the exchange rate they see must be up-to-date; otherwise, transaction errors and customer dissatisfaction may result.

2) Standardized Display

Information must be clear and easy to read. Font size, color scheme, and layout all require careful design.

Small fonts, low color contrast, or cluttered layouts can make it difficult for customers to see the information.

For example, if the lobby’s LED screen displays exchange rates, financial product returns, and stock market data simultaneously.

A poor layout may require customers to lean closer to the screen to see it clearly, disrupting the experience and appearing unprofessional.

3) Privacy and Compliance

LED screens should only display public financial information and not personal customer data such as account information, names, or transaction details.

LED screens are primarily used to display interest rates, exchange rates, financial products, market conditions, or policy announcements.

This not only protects customer privacy, but also complies with regulatory requirements and mitigates the risk of information leaks to banks.

6. Conclusion

In short, LED screens in banks serve a much greater purpose than simply displaying information.

They make complex financial data clear at a glance, making customer transactions more convenient and banking services more efficient.

Finally, for more information about LED screens, please get in touch with us.